Guignard: Central Florida’s Premier Provider of Surety Bonds

In the fast-growing heart of Central Florida, the construction industry is booming. From Orlando’s skyline expansions and new resort developments to the continuous public infrastructure upgrades in Orange, Seminole, and Volusia Counties, contractors are facing an increasing demand for credibility, compliance, and financial assurance. In this thriving but competitive environment, one company has earned the trust of builders and developers alike — Guignard.

Guignard is recognized as a Top Central Florida surety bond company, providing a full spectrum of surety services for the construction industry — including Bid Bonds, Performance Bonds, and Contract Bonds. With a strong local presence and a commitment to personalized service, the company empowers contractors to bid with confidence, secure project funding, and protect their clients.

The Orlando Construction Boom: Opportunity Meets Responsibility

Orlando and the greater Central Florida area are experiencing one of the most rapid phases of development in the state. From multi-billion-dollar transportation improvements to hospitality, retail, and residential expansion, the region’s growth is reshaping the economic landscape. However, with opportunity comes increased scrutiny from project owners and public agencies who must ensure contractors have the financial capacity and integrity to complete what they start.

That’s where Guignard Company plays a vital role. As a leader among Orlando surety bid bond providers, Guignard acts as a trusted surety agency between contractors, public entities, and private developers, ensuring that all parties are protected and that every project begins with a solid foundation of accountability and financial security.

Understanding Surety Bonds in Central Florida’s Construction Sector

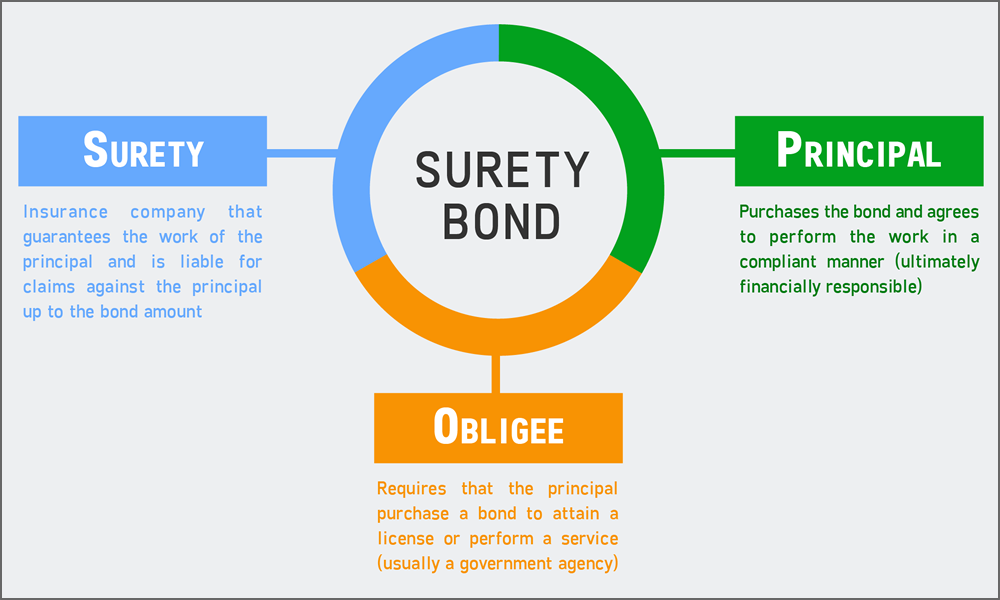

A surety bond is a three-party legal agreement that guarantees performance and payment obligations in construction contracts. These bonds are typically required on public projects and are increasingly common in private contracts as well.

The three parties involved are:

- Principal: The contractor or business seeking the bond.

- Obligee: The project owner requiring the bond.

- Surety: The company, such as Guignard, that helps the principal secure the bond for the contractor’s performance and financial reliability.

Guignard helps contractors at every stage of the process and provides ongoing relationship management. Its goal is not only to identify the bonding companies, but to help contractors expand their capacity and credibility to take on larger and more lucrative projects over time.

Comprehensive Surety Bond Services

Guignard Company’s expertise extends across the four essential categories of construction surety bonds. Each serves a unique purpose and offers specific protections to contractors and project owners.

1. Bid Bonds

A bid bond assures the project owner that the contractor submitting the bid has the financial strength and intention to honor its proposal if awarded the job. Without a bid bond, contractors cannot compete for most public works projects.

Guignard, a top Orlando surety bid bond provider firm, simplifies the bid bond process for Central Florida contractors. They help clients demonstrate capability and reliability before bidding begins. For many smaller contractors, this support can mean the difference between missing out and winning that first major public or private contract.

Bid bonds are also a strong indicator of a contractor’s reputation. Project owners see them as a mark of professionalism and trust. With Guignard’s help, even emerging builders can access this essential financial tool and position themselves as credible competitors in Florida’s thriving construction market.

2. Performance Bonds

Once a bid is accepted, the contractor must obtain a performance bond — a guarantee that the project will be completed according to the agreed-upon terms, specifications, and deadlines. Should a contractor fail to perform, the surety company provides compensation or arranges project completion.

Guignard’s relationships with leading national surety carriers enable them to secure performance bonds for projects of virtually any scale. Whether it’s a $250,000 municipal repair or a $25 million commercial development, Guignard’s clients benefit from prompt approvals, clear communication, and dedicated support from a team that understands the Central Florida construction market.

Performance bonds are particularly important in public infrastructure projects where taxpayer funds are at stake. Guignard has years of experience helping clients comply with key Florida agencies and departments, such as the Department of Transportation (FDOT).

3. Payment Bonds

A payment bond protects subcontractors, suppliers, and laborers by guaranteeing that they’ll be paid even if the primary contractor experiences financial distress or defaults. These bonds maintain fairness throughout the construction chain and prevent costly legal disputes.

Guignard incorporates payment bonds into most contract bonding packages, giving project owners and government agencies the confidence that all project participants are financially protected. This not only strengthens the contractor’s credibility but also promotes long-term business relationships built on trust and reliability.

Why Guignard Leads in Central Florida

Contractors have many choices when it comes to surety services, but Guignard distinguishes itself in several key ways that have made it the region’s most trusted bonding partner.

Local Presence and Deep Knowledge

Since its founding in 1977, Guignard’s Orlando office, located at 1904 Boothe Circle, Longwood, FL 32750, has been strategically positioned to serve contractors across Orange, Seminole, Lake, and Volusia Counties. Its local team understands the region’s regulatory environment and maintains relationships with city and county development departments.

For immediate assistance, contractors can contact the Orlando office directly at (407) 834-0022 for personalized bonding consultations.

Personalized Financial Guidance

Surety bonding is as much about financial health as it is about performance reputation. The underwriters the company works with review each client’s balance sheet, cash flow, and project history to determine appropriate bond limits and ensure that contractors are not overextended. The agency helps clients prepare accurate financial documentation to present to surety carriers, resulting in faster approvals.

Fast Turnaround and Digital Efficiency

In today’s competitive construction industry, timing is an important factor. Guignard uses modern digital tools to process applications quickly, minimizing paperwork and accelerating issuance. Many contractors receive expedited bond approvals as a result of the advanced preparation Guignard encourages.

Long-Term Relationship Focus

Unlike firms that treat bonding as a one-off transaction, Guignard builds enduring partnerships. As contractors grow, their bond requirements evolve. Guignard helps clients find the bonding capacity they need, enabling them to pursue larger projects and build more profitable business portfolios.

The Guignard Advantage for Central Florida Contractors

Guignard’s reputation in Central Florida is built on consistency, reliability, and financial strength. Contractors repeatedly turn to Guignard because they know they’ll receive:

- Access to top-tier surety carriers with national and regional expertise.

- Competitive premium rates that protect budgets without sacrificing protection.

- Trusted advisory support throughout the lifecycle of the project.

- Regional expertise with a team familiar with Florida’s construction and licensing environment.

Their ongoing relationships with developers, general contractors, and public entities have made them the first call for their Top Central Florida surety bonding company services.

How the Surety Process Works with Guignard

Contractors often find bonding intimidating, but Guignard’s process removes the confusion and potential delays. Their proven workflow includes:

- Prequalification: Reviewing the contractor’s financials, experience, and project pipeline.

- Bond Selection: Determining the right bond type and coverage for the contract.

- Underwriting: Matching the client with an appropriate surety carrier.

- Issuance: Finalizing the bond quickly and securely.

- Ongoing Support: Updating bond capacity as projects evolve.

Guignard’s consultative model helps ensure every client fully understands their obligations and opportunities under each bond type, building confidence and preventing future issues.

The Economic Impact of Surety Bonds in Central Florida

Surety bonds play a crucial role in sustaining Florida’s economy. By guaranteeing contract completion and payment, they maintain stability across the state’s massive construction sector. With billions invested annually in public and private projects, surety bonds protect both contractors and taxpayers from costly defaults.

In Orlando, where major transportation, housing, and tourism projects are continuously under development, Guignard plays a crucial role by helping contractors secure the financial backing required for Florida’s most complex projects.

Helping Small and Emerging Contractors Grow

Many of Guignard’s success stories involve contractors who started small — handling modest projects — ultimately growing into multi-million-dollar enterprises. Through careful financial planning and consistent bonding support, Guignard helps businesses expand their eligibility for larger contracts.

For new or minority-owned businesses seeking to enter the competitive world of public contracting, Guignard’s guidance on improving credit profiles, organizing financial statements, and preparing prequalification packages has great value.

Beyond Orlando: A Regional Network of Support

While Orlando serves as the company’s Central Florida hub, Guignard operates across multiple regions with equal strength and professionalism. Their additional offices provide broad coverage:

- Tampa Office: 1219 Millennium Pkwy, Ste 113, Brandon, FL 33511 — (813) 547-3773

- Atlanta Office: Deerfield Corporate Center One, 13010 Morris Rd, Ste 600, Alpharetta, GA 30004 — (678) 606-5533

This regional structure enables Guignard to handle both local and multi-state construction projects with ease, offering consistent service and compliance across jurisdictions.

Guignard’s Role in Public Sector Development

Guignard’s surety bonding support covers a wide array of projects throughout Central Florida, Tampa/St. Pete, and Atlanta, including:

- Public schools and educational facilities.

- Highway and infrastructure construction.

- Government office renovations and expansions.

- Parks and community development projects.

- Large-scale commercial and mixed-use developments.

Their long-standing relationships with public agencies and developers reinforce Guignard’s reputation as the Top Central Florida surety bond company trusted by government entities and private owners alike.

The Future of Surety Bonds in Central Florida

As Florida’s population continues to grow and infrastructure needs expand, the demand for surety bond services will only increase. Contractors that align with strong, experienced partners like Guignard will be better positioned to thrive in this fast-moving market.

Technology, efficiency, and risk management will define the next era of bonding. Guignard is already leading the way by digitizing the application process, integrating secure data tools, and streamlining documentation — ensuring that Central Florida contractors have the fastest, most reliable access to surety resources available anywhere in the state.

Your Central Florida Surety Partner

Whether you’re bidding on your first municipal contract or managing a multi-million-dollar resort project, Guignard stands ready to help. Their team provides practical, expert guidance on all aspects of construction bonds, including Bid Bonds, Performance Bonds, and Contract Bonds, so that every project begins with confidence and ends with success.

Contractors and developers can start their bond process online at

https://guignardcompany.com/bond-starter/

Or reach out directly to the nearest office:

- Orlando Office: 1904 Boothe Circle, Longwood, FL 32750 — (407) 834-0022

- Tampa Office: 1219 Millennium Pkwy, Ste 113, Brandon, FL 33511 — (813) 547-3773

- Atlanta Office: Deerfield Corporate Center One, 13010 Morris Rd, Ste 600, Alpharetta, GA 30004 — (678) 606-5533